Some Known Facts About Hard Money Atlanta.

The smart Trick of Hard Money Atlanta That Nobody is Talking About

Table of ContentsHard Money Atlanta Fundamentals ExplainedSee This Report on Hard Money AtlantaExcitement About Hard Money AtlantaHard Money Atlanta Fundamentals ExplainedHard Money Atlanta Things To Know Before You BuyThe Facts About Hard Money Atlanta Uncovered

These tasks are generally completed rapidly, hence the need for quick accessibility to funds. Make money from the task can be made use of as a deposit on the following, consequently, tough cash financings permit capitalists to range as well as flip more residential properties per time. Provided that the repairing to resale time framework is short (typically much less than a year), residence flippers do not require the long-term lendings that traditional home mortgage lending institutions use.Usually, these aspects are not the most vital consideration for funding credentials. Interest rates may likewise differ based on the lending institution and also the deal in question.

Some Of Hard Money Atlanta

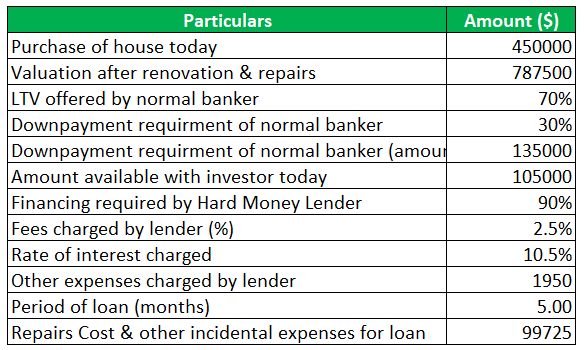

Hard cash lending institutions would additionally bill a cost for giving the financing, and also these costs are likewise called "points." They typically end up being anywhere from 1- 5% of the complete financing amount, nevertheless, points would usually amount to one percent point of the car loan. The major distinction in between a hard cash lending institution as well as other lending institutions hinges on the approval procedure.

A tough money lender, on the various other hand, focuses on the property to be bought as the top factor to consider. Credit report, income, and also other specific demands come second. They likewise differ in regards to simplicity of accessibility to funding and also rates of interest; difficult money lending institutions offer moneying rapidly and also charge greater rate of interest as well. hard money atlanta.

You can find one in among the following methods: A straightforward internet search Demand referrals from local property representatives Request suggestions from real estate financiers/ capitalist groups Because the loans are non-conforming, you must take your time assessing the requirements as well as terms supplied before making a calculated as well as educated choice.

The 9-Minute Rule for Hard Money Atlanta

It is necessary to run the numbers prior to selecting a tough cash loan to ensure that you do not encounter any loss. Look for your hard money loan today and obtain a lending commitment in 24 hrs.

A difficult money financing is a collateral-backed finance, safeguarded by the real estate being acquired. The size of the loan is established by the estimated worth of the residential property after proposed fixings are made.

Many hard money lendings have a regard to six to twelve months, although in some circumstances, longer terms can be organized. The consumer makes a regular monthly settlement to the loan provider, typically an interest-only payment. Right here's just how a common tough money finance works: The debtor wishes to buy a fixer-upper for $100,000.

Indicators on Hard Money Atlanta You Should Know

Some loan providers will certainly need even more cash in the bargain, and also ask for a minimum down settlement of 10-20%. It can be advantageous for the investor to seek the loan providers see this site that need very little down repayment alternatives to lower their cash money to shut. There useful reference will certainly likewise be the normal title fees connected with shutting a deal.

Make certain to contact the tough money lender to see if there are prepayment fines billed or a minimum yield they call for. Presuming you are in the car loan for 3 months, and the residential or commercial property sells for the predicted $180,000, the financier earns a profit of $25,000. If the property costs more than $180,000, the buyer makes more money.

Because of the much shorter term as well as high rate of interest, there typically requires to be restoration and upside equity to record, whether its a flip or rental home. A tough money finance is perfect for a customer that wants to fix as well as flip an you can try this out undervalued home within a relatively brief period of time.

All about Hard Money Atlanta

Rather than the typical 2-3 months to shut a traditional mortgage, a hard money finance can typically be closed within a matter of a couple of weeks or less. Hard money finances are additionally excellent for borrowers who might not have W2 work or loads of reserves in the bank.

Hard money lenders will lend as much cash as the rehabbed residential or commercial property is worth. Additionally, some borrowers use hard cash loans to link the void in between the acquisition of an investment home as well as the procurement of longer-term funding. hard money atlanta. These buy-and-hold capitalists make use of the difficult money to acquire and also renovate residential or commercial properties that they then re-finance with traditional lendings and take care of as rental properties.

Fascination About Hard Money Atlanta

Borrowers pay a higher rate of interest for a tough cash finance due to the fact that they do not need to leap via all the hoops called for by conventional loan providers in addition to getting more funds towards the purchase price and renovation. Hard cash lending institutions consider the property, along with the consumer's strategies to boost the residential property's worth as well as pay off the lending.

When applying for a difficult cash car loan, borrowers require to show that they have adequate capital to efficiently get via a deal. (ARV) of the property that is, the approximated worth of the residential or commercial property after all renovations have been made.